Stock exchange trading is very much influenced by emotions.

When trading on the stock exchange, you need to learn to manage your emotions.

How well you manage your emotions determines whether you’ll win or lose.

This challenge is particularly difficult to master for many investors and traders.

You may be able to analyze stocks excellently or have insider insights into profitable companies.

If you cannot withstand the pressure of buying or selling stocks, your chances of sustained stock market success are not necessarily good.

Before you can systematically make a profit, you need to know yourself and be able to reflect on your psyche.

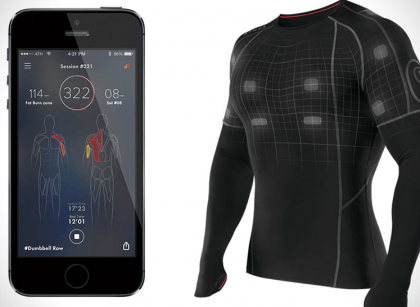

There are trading mobile apps to help you learn basic and advanced trading strategies.

Watch Yourself Trading

Emotions affect us in trading, especially when we want to start or close a trade.

If the last transactions went very well, then you are very likely to press the buy button fairly quickly (too quickly?), Because profits are known to be addicting.

If you were unlucky in the end and a profit turned into a big loss, then you may be taking too high a risk to get “your money” back.

After a series of losses, however, most investors will act too hesitantly or not at all, even with first-class opportunities.

However, one thing is clear: if the motivation is not right, in most cases, the result will not be right either.

A very helpful exercise that will help improve your performance is as follows:

Just before submitting an order, take a step back and take on the role of an observer.

That sounds a little abstract and requires a little explanation right, OK!

When you are sitting in front of the computer and you are about to take on a new position, do not press the button immediately, but look at yourself as an outsider.

Imagine standing next to or behind your chair and seeing yourself sitting there. Observe what is happening objectively and analytically.

- Do you want to enter or exit a stock position for rational reasons?

- Are you following your investment strategy consistently?

- Are emotions or other motives irrelevant?

- Is this the best time to place this order?

If you can answer these questions with “yes” with complete conviction, then you can “return to yourself” and submit the order with a good feeling.

Give it a try. You will see that this perspective will have a noticeably positive effect on your results.

Keep a Trading Diary

In our example below, we consider a small entrepreneur who runs a growing company and is also active in the stock market.

The entrepreneur will likely know very well how high his daily turnover is, what his profit margins are, which products sell well and which remain in the warehouse as slow-moving items.

Nonetheless, it is also very likely that he has no idea how much he will gain or lose on average with a stock position when he realized his biggest loss and which of his strategies are the most successful.

A few studies showed that there is often a significant difference between what investors think – namely the profit they have made in recent years – and actual performance.

“The correlation between the estimated and the actual performance of our test group over the past 4 years is almost zero .”

You can remedy this by consistently keeping a trading diary.

Write down everything related to your investment decisions and positions.

Make a note of exactly why you took each position and where your stop loss and profit target are.

You can also save a chart and mark your entry and exit points.

With a trading diary, you can keep a good overview of your investments.

Careful follow-up of your trades then reveals errors relatively reliably and is the first step towards a successful next trading day.

Contents of a trading diary

Every trade is documented in the trading diary, there should be no exceptions.

This makes it easier to analyze success and failure later. And that is the foundation for good analysis.

- Trading idea

- Dates / News

- Underlying

- Purchase date

- Buy limit/purchase price or execution price

- Item size/number of items

- strategy

- Stop-loss / max. loss

- Profit target / target price / planned profit

- Planned trade duration

- Selling rate

- Your emotions when entering the position and during the trade

- Trading diary template

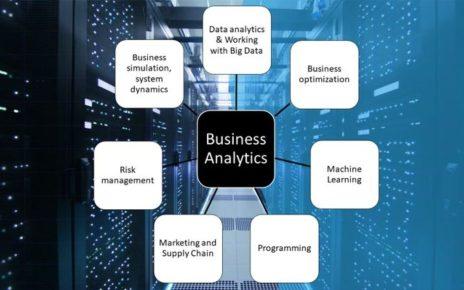

Know the Rules of the Game

You can’t win a game in the long run if you don’t know the rules.

Perhaps, you will have the luck of a

beginner trader, but in the end, you will be playing against people and computer programs who perfectly know and use the rules and framework conditions.

As with any game, the financial world has many rules and regulations.

You have to know and understand the products that you trade.

- When do options expire and how can they be exercised?

- What is the margin requirement for a DAX future?

- What happens to my euro or dollar account when I trade in foreign currencies?

- In addition to knowing about products, you should of course also know about the general economic situation.

- Is a low-interest rate positive or negative for stocks?

- What is the role of the ECB? At what rate does it become difficult for state governments to finance their debts? And so on.

By reading the business press regularly, you will quickly develop a feeling for which changing topics are currently considered relevant to the stock exchange.

So always keep yourself up to date.